The Costs of Mis-Hiring in Sales: The True Toll on Businesses

Exploring the Financial and Organizational Consequences of Hiring the Wrong Salespeople.

Behind every successful sales team lies the careful selection and placement of talented individuals who drive revenue and foster growth. Yet, when a mis-hire occurs, the repercussions can be far-reaching, both in financial terms and the overall health of the organization. In this blog post, we delve into the untold story of mis-hiring in sales, unraveling the hidden price tag that accompanies such mistakes.

In the world of sales, hiring the right individuals is crucial for achieving revenue goals and maintaining business momentum. Unfortunately, mis-hiring can have devastating consequences, both financially and organizationally.

Every leader should understand the true cost of a mis-hire to their business. By understanding the true extent of these impacts, we can begin to take steps to mitigate the risks of mis-hiring as well as better understand the return on investing in recruiting, onboarding, training, and retention of people.

Missed Revenue Goals

Companies create revenue goals and aim to hire the right number of salespeople needed to hit their goal. It’s simple logic but needs to be said plainly.

If your business relies on humans to drive for revenue, then you need a certain number of salespeople to start at a specific point in time, ramp up on the product/process, and hit their revenue targets.

If a company doesn’t hire enough people by a deadline then they will miss their revenue goals. If a company mis-hires enough people, they can also miss their revenue goals.

If your organization misses goals, there are many repercussions, such as not being able to raise your next round of funding, lost momentum in the business, etc.

The real cost of consistently mis-hiring in sales is a failed company.

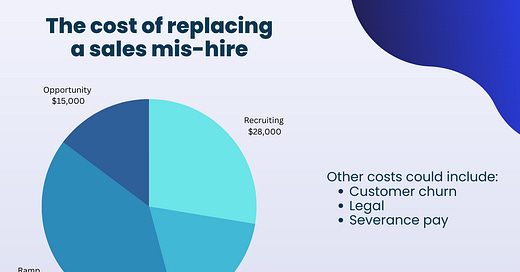

Breaking down the cost of a single sales mis-hire

Different sources will provide different numbers, but you’ll find people saying the cost of a sales mis-hiring can range from $17k to as high as $240k. There are things that can be measured, such as replacement cost, but then there are intangible costs like decreased morale and momentum that are the true silent killers.

The “tangible” examples below are based on an assumption of base pay, variable pay, average annual contract value, cash flow of deals brought in, speed of which reps are ramped, no churn on deals closed, etc. I urge everyone to run this “back of the envelope” math with their own sales numbers to make this example personally useful for their business.

For this exercise, let’s say a sales rep has a base salary of $100k with a total compensation package of $200k at the end of the year and sells $20k in annual contracts for their employer. Now, let’s say the rep is underperforming and there’s no opportunity to “save” him/her because they are, for one reason or another, not a fit for your company.

How much of a potential financial impact will the business take if they need to replace the rep and start all over again?

Recruiting

When factoring in the costs associated with advertising and posting open positions, you could spend as much as $4,000. If you decide to utilize the services of an outside recruiting agency, the cost could be $20,000+ (20-30% of the annual base salary is standard). Some agencies will also charge a retainer on top of the percentage. It’s not uncommon for companies to utilize internal and external resources for the same role, but what about the time investment?

Think about the hours your interview panel spends on interviewing and not actually moving the bottom line. We've seen the average be around 63 hours interviewing and 66 hours prospecting when using LinkedIn to make one hire:

Prospecting: 1,000 people = 66 hours or $3,960 ($60/hour) -- 15 candidates per hour

Interviewing: 100 R1 30 minutes | 10 R2 60 minutes | 3 R3 60 minutes = 63 hours or $3,780 ($60/hour)

So this is $7,740 just for one hire. Not to mention, execs make more than $60/hour.

Recruiting can be broken down into sourcing and screening. For sourcing, let’s take the outside agency rate at ~$20k and the screening from your team at ~$8k for a total of $28k per hire.

Pro Tip: To mitigate this, create deep alignment about the position with your team. Follow this 3-part series about creating your internal job order, team alignment, and candidate-facing job descriptions to get started.

Training & Onboarding

For every new hire, there is someone that must invest time into training. Whether it's the direct manager or a dedicated learning and development team, someone is there with the new hire. Training is an ongoing investment, but for the sake of this exercise, let’s assume there is a heavy 60-day upfront investment.

Even if you have other reps assist with training to help a peer learn, there is an opportunity cost involved. If 3 sales reps take 3 hours a week to help at that same $300/hour in opportunity cost of a $600K quota (Why $600k in the section below), when you factor in the other reps missing out on closing deals to spend time helping a new hire, it can cost the business $2,700 per week or $21,600 for 2 months of invested time.

To take the average across learning & development, management, and peer learning examples we have an average investment amount of $18,500 per rep.

PRO TIP: If possible hire salespeople in batches at the same start date to reduce training and onboarding costs for each hire.

Ramp

In the example above, this rep costs the business $200k/annually so, on average, he/she should produce ~$600k in return for the business (3x multiplier on OTE). The idea is that a sales rep should generate enough revenue to cover their costs and then some. In this case, the $200,000 cost of the sales rep includes their salary, benefits, and other expenses. The company needs to take into account the cost of goods sold (COGS). This means that the company needs to sell a lot of products in order to actually make a profit.

With $20k annual contract values, we need this rep to close 2-3 deals a month.

$600k/$20k per deal = 30 deals

30 deals/12 months = 2.5 deals per month

During the sales ramp phase, when a salesperson has the training wheels still on and not having a full ramped quota, the business is usually losing money on the employee as they get up to speed on the product and sales motion.

A sales rep won’t walk into your organization and produce these 2.5 deals right out of the gate. Let’s assume your organization provided a 3 month guarantee to the rep on their on-target earnings. This means you’re paying $16,667/month for the first quarter for a total of $50k.

During ramp, you forecast that reps are able to produce 1 deal per month for the first quarter so $20k/deal X 1/deal per month X 3 months = $60k.

The business spent $50k in a guaranteed salary and received ~$10k in production from the rep for a loss to the business of $40k in the first 3 months. This example doesn’t include the compounding effects of deals brought in or deals churned. As you run the “back of the envelope” math, understand your break even point for rep production and take into account the lifetime value of your average customer.

PRO TIP: Onboarding employees effectively reduces ramp time and speeds up the time to productivity. Check out this post for sales onboarding tips.

Opportunity cost

It’s better to not hire someone than hire someone bad for all the reasons mentioned above. But what about retaining existing employees that are producing for your business?

How much would a fully ramped rep produce if you kept them three more months?

If you’re able to hang on to reps that produce results, this reduces the risk of mis-hiring and incurring all these other costs.

A fully ramped rep produces $50k in gross revenue for the business every month (2.5 deals X $20k/deal X 1 month = $50k). For 3 months that would be $150k

A ramping rep produced $20k in gross revenue for the business every month (1 deal X $20k/deal X 1 month = $20k). For 3 months that would be $60k

This example above assumes the ramping rep starts on the same day the fully ramped rep leaves and doesn’t take into consideration compounding revenue from the deals brought in the past 3 months or deal churn.

The estimated gross earning lost in 3 months is $90k ($150k - $60k). For the final cash flow calculation, we got to $15k loss ($25k - $10k) but, with this example, depending on how you slice it, this can easily be the largest line item in your calculation.

PRO TIP: Value your people and work to retain them. Retaining great people isn’t always about money. Understand what motivates each individual and help them get to where they want to go.

Adding up all the sections above we get to a total loss of over $100,000 for mis-hiring one sales rep. However, It’s not hard to see how someone can easily get to $200k+ in estimated cost per mis-hire.

Other tangible cost can include:

Customer churn: If the bad sales hire alienates customers it can lead to lost revenue

Legal: If a bad sales hire makes false or misleading statements to customers along with employee/employer lawsuits

Severance: To amicably exit the working relationship

Intangible:

Momentum: As discussed in the first point with enough mis-hires a company risks killing its business. An executive team must push forward with hiring goals and deadlines to give themselves a chance of hitting their revenue targets but with the wrong hires the wind is taken out of the sails

Damage to morale: A bad sales hire can damage morale among other sales reps. The mis-hire could bad mouth leadership, the company, the vision, etc. This attitude can spread fast in an organization

Damage to the company's reputation: A bad sales hire can “burn” prospects, making it more difficult to attract new customers and partners.

As an action item to this post, run the “back of the envelope” numbers utilizing the same categories (Recruiting, Onboarding/Training, Ramp, Opportunity Cost) to gauge the cost of one sales mis-hire.

After you're done with that exercise, list out the low hanging fruit you can impact within 30 days. Decide which categories you invest your time or capital or both to mitigate negative outcomes.

Looking for more great content? Check out our other blog posts. And follow us on Linkedin.

Interested in becoming a Leap Advisor? Learn more about the process here.